If I were starting another company today I’d probably build something around social networks.

I think we’re at an inflection point with the legacy platforms, but still lots of open space for upstarts to figure out what’s next.

Rationale for why and thoughts on how:

Social connection is a core human need. It’s universal and not going anywhere. Essential needs are the best use cases to be building into. This is the #1 reason why this space is so full of opportunity.

Second, incumbents are unpopular and proving themselves incapable of change. While their usage metrics keep going up, there’s an underlying emptiness and unhappiness with the experience. This means the shift won’t happen, then it will happen all at once. Outside of the network effects, users have very little loyalty to the incumbents. When network effects flip negative, they unravel faster than people imagine.

Third, compared to other markets, there is relatively little innovative competition. FB has used its distribution advantage to replicate a lot of social network products (e.g. Snap). Has disheartened a lot of would-be challengers. But that's more open space to innovate.

Last but not least, fixing social media feels like an important enough mission that you’d be able to recruit some extremely talented people to work together on it. Having that is always an accelerant.

That said, I don’t think it would look anything like an existing social network (IG, tiktok, FB, Snap, etc.)

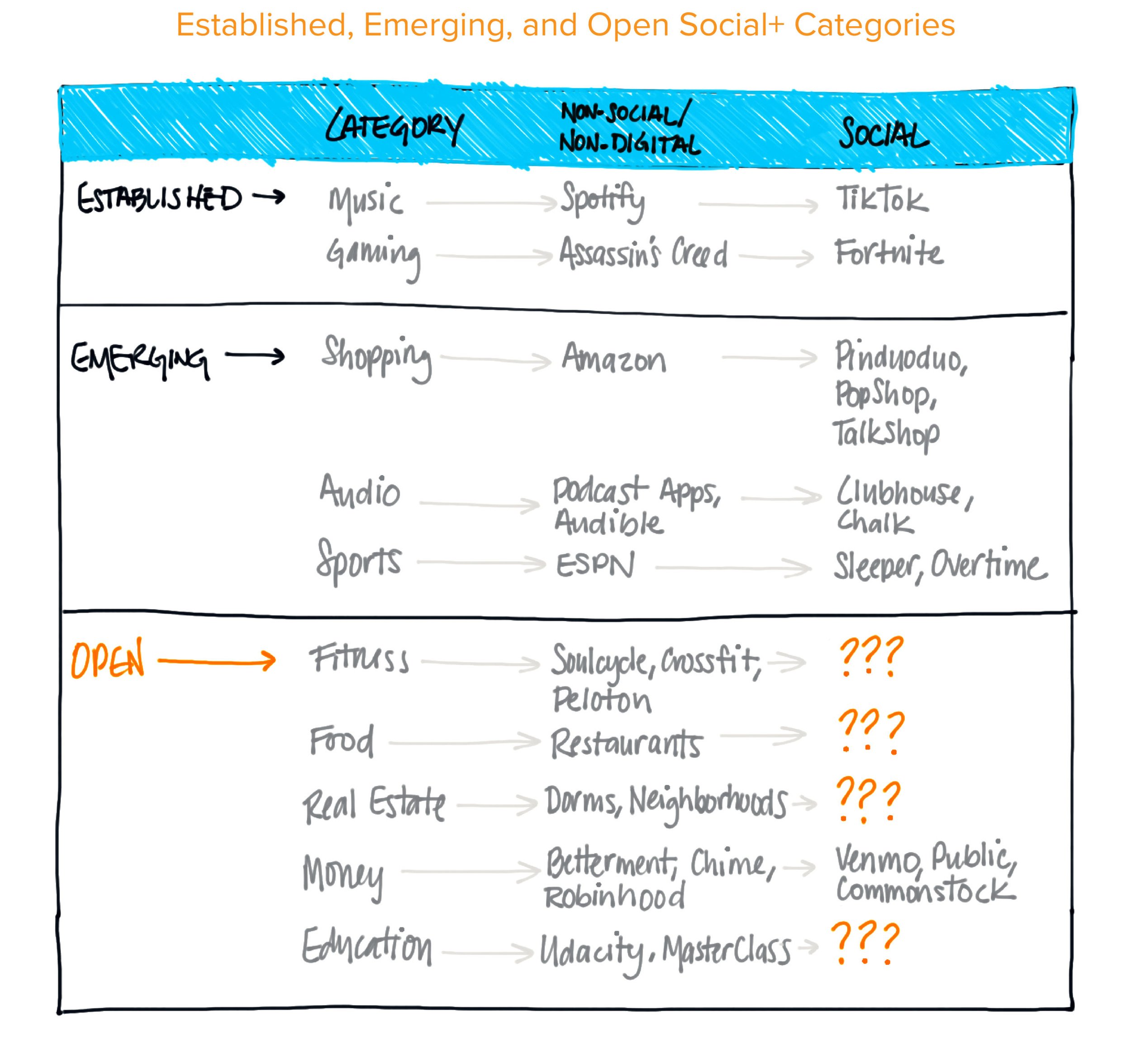

First off, it would be tailored to a specific vertical community. Think urban millennials, retired boomers, fitness fanatics or new moms. Each one of these is will be their own network. A user's future network is more like a series of Reddits than a consolidated newsfeed.

Legacy behemoths often fall prey to a pack of vertical players that provide a more tailored (and obviously better) experience for a subset of users. ebay and Craigslist have been fertile ground for a while. IMO the broad social platforms are next.

The experience will feel more like a “product” than today’s “social networks”. Games like fortnite or roblox are one example of this. People think of them as games, but it’s the social element that makes them really work.

Many of these social networks will have significant IRL elements because that’s what certain vertical communities want. The Wing is one example where their community wants genuine IRL interaction. Give the people what they want!

I also think it's unlikely the business model would be ad based. Why build on a premise that is driving so many of the problems in the incumbents? Also a differentiated business model makes it harder for incumbents to copy you.

Would have to pick a business model that is consistent with the product and community, but memberships, tipping, and in-app purchases are all models I'd explore.

Interesting side effect of this is that it makes these models more likely to stay as pure social networks, rather than grow into social media like the last generation.

I'm excited for the founders building these new social networks.

They say timing is always the hardest thing to get right, but their timing feels Massive opportunity that IMO will feel obvious in hindsight.

Bright days ahead.

(Originally published as a tweetstorm on July 22nd, 2019)